The Exactech lawsuit has become one of the most significant medical device legal battles in recent years. It arose after thousands of patients reported failures in their knee, hip, ankle, and shoulder implants. These devices, manufactured by Exactech, were designed to restore mobility and alleviate pain. Instead, many broke down far earlier than expected.

The issue came from defective packaging that allowed oxygen to damage critical parts before surgery. Patients experienced severe pain, swelling, and joint instability. Many required risky and costly revision surgeries. The recall of hundreds of thousands of implants triggered a wave of lawsuits across the United States. Federal and state courts now handle thousands of claims. Bankruptcy proceedings have added another layer of complexity. This case has drawn national attention, highlighting patient safety concerns, corporate accountability, and the long fight for fair compensation.

What Caused the Exactech Lawsuit?

Problems like oxidation and wear triggered device failures. Patients encountered pain and instability. Understanding the cause shapes the legal response.

Faulty Packaging Led to Device Failure

Exactech used packaging that lacked durable oxygen barriers. Oxygen seeped into sealed bags. Polyethylene liners oxidized inside. This degradation caused early wear. Joints failed prematurely. That failure led to breakdown, inflammation, and loss of mobility. Patients faced revision surgeries. Surgeons found bone loss and implant loosening. Many only discovered the problem after needing second or third operations. Some required complex reconstructive procedures. Tests confirmed oxidation as the root cause. That fact underlies the core of the lawsuit.

Massive Recall of Joint Implants

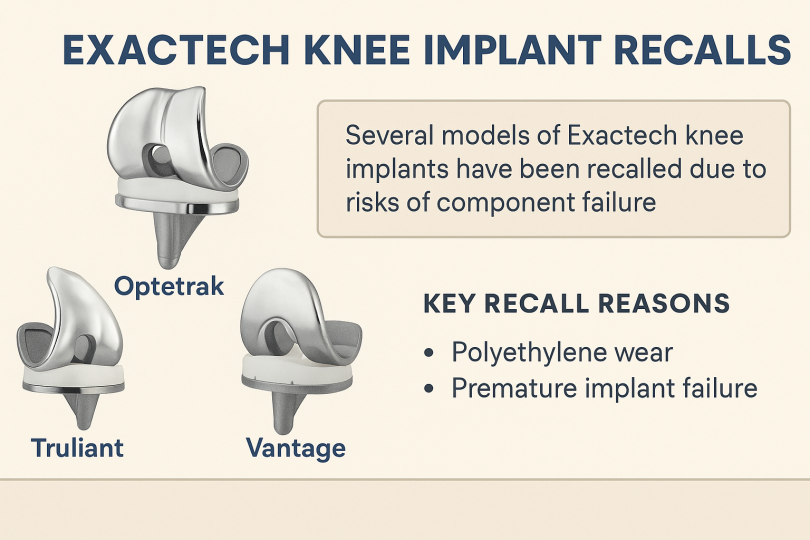

Exactech issued recalls covering devices from roughly 2004 to 2021. It included knee implants named Optetrak, Optetrak Logic and Truliant. Hip liner recalls included Connexion GXL and others. Ankle system Vantage also appeared in recall lists. Shoulder liner issues prompted expansions of the recall in 2024.

Numbers reached hundreds of thousands across categories. Those recalls stirred patient concern and media scrutiny. Hospitals and outpatient clinics scrambled to notify affected individuals. Surgeons reviewed records to identify impacted cases. Regulatory bodies like the FDA posted updates. Patient safety became a national talking point. The massive scale underscored severity of the defect.

MDL 3044 Consolidation of Lawsuits

Thousands of lawsuits emerged across the U.S. courts. To manage complexity, judges merged them into MDL 3044. That took place in the Eastern District of New York. It falls before Judge Nicholas G. Garaufis. The MDL structure pools pretrial proceedings. It streamlines document exchange and expert reviews. It avoids conflicting rulings across districts.

Case management orders guide scheduling, discovery, and fact sheets. Lawyers submit similar evidence in one venue. That improves consistency. It also reduces costs. Plaintiffs benefit from shared resources. Defendants face coordinated oversight. Courts schedule “Science Day” events. Experts testify over polymer degradation science. It clarifies technical aspects. All sides prepare for bellwether trial selections. That next phase shapes settlement talks.

State Court Cases in Florida and Elsewhere

Not all cases entered the MDL. Florida courts grouped many cases under their own multi-plaintiff track. It’s managed under statewide coordination. Illinois and other states host their own proceedings too. The parallel tracks run independently of MDL.

They use local judges, rules, and timelines. That diversity may yield varying outcomes. It also provides alternatives if MDL stalls. Plaintiffs can choose based on speed, strategy, or location. But bankruptcy filing affects all tracks. That stay extends across federal and state levels. Understanding your venue matters. Coordination across venues still occurs informally. Lawyers compare strategies across courts. That shared insight may influence filing or settlement decisions.

Timeline of Key Developments

A timeline clarifies how events unfolded. It shows recall, lawsuits, MDL creation, bellwether plans, bankruptcy, and current status. Each phase connects to the next. Delays, stays, and shifts compound complexity. Clear sequence helps patients and attorneys plan steps ahead.

2021–2022: Recall and Early Lawsuits

Exactech’s first recall hit the Optetrak knee devices in early 2021. Later that year, it expanded to include hips and ankles. The recall announcement triggered media coverage. That, in turn, sparked patient inquiries and concern. By mid-2022, the volume of lawsuits soared. Injured patients filed claims in multiple courts. Legal counsel grouped cases. They petitioned Judicial Panel on Multidistrict Litigation (JPML). JPML acted in October 2022. It centralized cases under MDL 3044. That marked a new stage. It changed strategy and litigation landscape.

2023: MDL Moves Forward

During 2023, judges issued case management orders (CMOs). They guided early document disclosures, structured expert deadlines and coordinated timelines. They held a Science Day. Experts discussed chemical oxidation under microscope. The hearing provided jurors, judges, and lawyers with technical clarity. Plaintiffs and defendants exchanged views on failure modes. That helped shape trial preparation. Discovery proceeded across medical records, device data, and manufacturing files. Fact sheets captured patient symptoms, surgeries, and outcomes. That supported early evaluation and potential settlement discussions.

2024: Bellwether Trials Set

Moving into 2024, courts selected a few cases as bellwethers. Tarloff and Larson became two test trials. These would start in 2025. Their outcomes could set tone for broader settlement negotiations. Plaintiffs hoped verdicts would prompt fair offers. Exactech prepared defenses on technical grounds. Witnesses included engineers, surgeons, and product developers. Lawyers simulated trial testimony. Courts considered deposition schedules. All parties expected motion practice to intensify. Those bellwethers attracted attention in filings and press.

October 2024: Bankruptcy Filing

Unexpectedly, Exactech filed Chapter 11 in Delaware in October 2024. It listed around $352 million in debt. Its recall-driven liabilities triggered the move. The firm sought debtor-in-possession financing of $85 million. That step allowed reorganization. Bankruptcy court emerged as new center of gravity. The filing paused litigation across MDL and state courts. Many saw this as strategic protection. Plaintiffs now awaited procedural direction from bankruptcy judges.

Early 2025: Bankruptcy Halts Litigation

Once the automatic stay took effect, all new and ongoing lawsuits ceased. Judges in MDL and elsewhere removed trial dates. Lawyers paused discovery and filings. Plaintiffs awaited plan proposals. That delay frustrated claimants. They watched bankruptcy filings for timelines. Delays could last months. Meanwhile, Exactech maintained device operations. It continued sales, service, and support. Trust documents began to emerge behind the scenes.

Mid-2025: New Bankruptcy Exit Plan

Around mid-2025, Exactech proposed a revised exit plan. It removed previous terms protecting TPG. The plan included setting up a claims trust. That trust would evaluate and pay patient claims. It would consolidate liabilities outside court. Lenders—those holding debt—would take ownership post-bankruptcy. Press reports estimated potential claim volume above $1 billion. Plaintiffs awaited confirmation hearings. Courts would review binding terms. If approved, trust will stringently manage claims. Payment schedules would follow trust parameters.

May 2025: Critics Sound Alarm

Media investigations highlighted heartbreak stories. Gene Davis, for instance, endured multiple surgeries and severe disability. Journalists explored links between private equity ownership and failure to prepare for liability. They questioned the fairness of Chapter 11 strategy. That reporting stirred public outrage. It may influence judicial openness to generous payouts. It might sway future legislative oversight. Patients felt vindication. Legal observers reevaluate financial motives behind mass tort bankruptcies.

Who Is Involved?

This subsection highlights major roles and relationships. It clarifies who stands where. Legal responsibility, ownership, and court roles all matter.

Patients and Plaintiffs

People of all ages and backgrounds suffered failures. Their claims include pain, loss of function, and repeated surgeries. Some lost jobs or needed rehabilitation. Others sued due to lifelong disability. They bring claims for physical harm, emotional distress, and economic losses. Lawyers represent hospitals, retirees, athletes, and everyday workers. They prepare case files with medical documents and witness statements. Plaintiffs seek compensation to rebuild life and trust.

Exactech

The company began in Florida in 1985. It specialized in joint replacements. It designed implants and packaging meant to last years. Their products gained wide use worldwide. Innovations included low-friction polyethylene liners. Those liners failed due to packaging defects. Exactech disputes liability. It argues seal integrity passed in-house tests. It blames storage conditions or patient factors instead. That defense triggers technical disputes over failure causes.

TPG Private Equity

TPG acquired Exactech circa 2018. The business then had access to more capital. Critics allege TPG influenced design and packaging. Plaintiffs attempted to hold TPG liable. They argued TPG directed decisions that contributed to failure. Courts dismissed TPG initially. They found no sufficient evidence of control or negligence. Advocates plan appeals. That status could change if trust reconstruction reveals new evidence.

Federal and State Courts

Federal MDL 3044 in Brooklyn handles most lawsuits. That court issues centralized rulings. Related state courts run separate tracks. Each follows its own managing judge and schedule. These courts communicate informally. Rulings in one might influence another. Bankruptcy now dominates all courts. They await guidance from Delaware’s bankruptcy judge.

Bankruptcy Court

Delaware adjudicates Exactech’s Chapter 11. That forum determines exit strategy and ensures legal compliance. Judges review assets, creditors, and trust proposals. Any payout must align with bankruptcy law. The court decides on fairness to claimants versus investors. That decision could involve contested hearings. Stakeholders present evidence. The court ultimately approves or denies the plan.

What’s at Stake?

This section breaks down the key consequences. It separates personal, legal, financial, and societal stakes. Each deserves its own focus.

Patient Health Outcomes

Surgical failures cause severe pain and loss of mobility. Many suffer bone erosion and swelling. Revision surgeries carry more risks. Some develop osteolysis and chronic instability. Recovery can take months or years. Some never fully recover. Even after surgery, quality of life remains reduced. That damage can affect careers, relationships, and independence. Patients face physical and emotional hardship. They also accumulate high medical bills. That burden amplifies the need for compensation.

Legal Compensation

Claims aim for recompense for medical costs, lost wages, and pain. Cases vary widely based on evidence and outcome. Revision surgery cases may claim up to $300k. Others settle around $100k. Economic damages play a big role. Plaintiffs also seek punitive damages. Those aim to deter future misconduct. Settlement pools depend on trust funding and claim volume. Recovery now hinges on plan approval and fund sufficiency. Some plaintiffs may part-carry legal costs before recovering full amounts.

Bankruptcy Effects on Recovery

Chapter 11 grants protection from lawsuits. Plaintiffs cannot pursue cases outside the bankruptcy process. The court controls payouts. That may limit individual verdicts. Instead of jury awards, claimants rely on trust distributions. That transition changes legal strategy and expected timelines. Funds may spread across thousands of claimants. This dilution reduces per-claimant recovery. Some fear windfalls for investors over patients. Others hope trust speed will deliver payouts faster than protracted trials.

Precedent for Private Equity Strategy

TPG’s role raises questions about private equity and risk. Critics suggest bankruptcy planning may shield investors. Without sufficient reinstall of oversight, failure risks repeat. That strategy might become road-map in future mass torts. Patients, advocates, and lawmakers may push for transparency reforms. Regulatory bodies may demand more active oversight. Legal ethics debate arises over defensive bankruptcies in product liability cases.

What Happens Next?

This section maps forward paths through bankruptcy and legal strategy. It explains what actions loom and who moves next.

Finalizing the Bankruptcy Plan

Exactech must get court approval for its reorganization. If approved, lenders gain control. The claims trust forms. It will review and evaluate claimant submissions. Trustees oversee fairness and funding. That process replaces jury trials. Payments follow trust guidelines. Trust may set tiers based on injury severity. Some plaintiffs may recover quickly. Others might see delayed or partial compensation.

Bellwether Trials May Never Occur

Scheduled trials in 2025 may collapse. Bankruptcy overrides MDL progress. Bellwether results now unlikely. That removes public verdicts that might pressure settlement. Plaintiffs rely on trust instead. That method lacks jury interaction. Outcomes may feel remote and abstract to claimants.

Judge May Revisit TPG’s Dismissal

Plaintiff counsel plan to seek reconsideration. They believe new facts show TPG’s influence. Bankruptcy filings may reveal more internal communications. If TPG returns to litigation, it could expand the defendant pool. That raises settlement fund demands. It also shapes liability dynamics. Courts may reopen that chapter if evidence warrants.

Claim Filing Deadlines

Trust administrators will set deadlines. Missing a deadline could bar recovery. Lawyers must file accurately on time. Claim forms will require proof of injury, device records, and medical bills. Plaintiffs must track notices carefully. Courts or trustee websites will publish dates. Attorneys must alert clients well in advance.

Fund Availability

If total claims exceed available funds, distributions shrink. A pool over $1 billion may stretch small. Trust may prioritize severe cases. Lesser claims may yield small payouts. Claim volume will shape planning. Negotiations among claimants may affect final settlement structure.

Continued Media and Legal Attention

Investigative reports may shape public sentiment. That could pressure courts politically. Legislators may consider regulations targeting private equity in medical devices. Advocacy groups may push for patient-friendly policies. Lawsuits in other countries may follow suit. Public chatter influences occasionally legal calendars through social and political influence.

What You Should Do If Affected

This section guides practical steps. It ensures patients follow key actions. It aims to empower claimants in a chaotic process.

- Check your device.

Visit Exactech’s recall page. Use your implant’s serial number. Confirm exposure risk. Reach out to your surgeon’s office if number is missing. Keep documentation. - Visit your doctor.

Ask an orthopedic to assess your implant. Request imaging like X-rays or MRI. Early detection may curb damage. Document findings carefully. - Document injuries.

Save all medical records. Include surgery notes and imaging. Keep bills and receipts. Labeled files make claims easier. - Talk to a lawyer.

Reach counsel versed in MDL 3044 or bankruptcies. Ask about filing strategy and trust process. They will track deadlines and encourage filings. - Stay alert.

Monitor court filings or trustee updates. Sign up for alerts on MDL or bankruptcy sites. Join claimant groups online if helpful. - Act fast.

Once trust forms, deadlines will follow quickly. Delays might mean lost recovery. Prioritize filing support and updates.

Summary of Key Facts

This table captures critical data at a glance:

| Topic | Detail |

|---|---|

| Recall Scope | Implant packaging failed; recall covers many joint devices from 2004–2021 |

| Lawsuit Consolidation | MDL 3044 in E.D.N.Y.; plus state tracks in Florida and other states |

| Case Volume | Roughly 1,840 MDL cases plus an estimated 700 more in states; totals near 2,600 |

| Bankruptcy Filing | Exactech filed Chapter 11 in October 2024; debt about $352 million |

| Status | Litigation paused; trust formation in progress |

| TPG Role | Private equity owner; dismissed from cases; possible return if evidence supports |

| Potential Recovery | Estimated recovery per claim ranges $100k–$300k; total claims may exceed $1 billion |

| Next Steps | Court to decide exit plan; trust will evaluate and process claims |

That snapshot reminds readers of scope, impact, and unfolding developments. Each point ties back to sections above.

Frequently Asked Questions (FAQs)

1. What products were included in the Exactech recall?

The recall includes joint implants with polyethylene (plastic) inserts for knees, hips, ankles, and shoulders made since 2004. These include knee systems like Optetrak, Optetrak Logic, Truliant; hip liners like Connexion GXL; and ankle product Vantage.

2. What caused the recall in the Exactech lawsuit?

Exactech used “non-conforming” packaging bags that lacked a secondary oxygen barrier. This packaging failure allowed oxygen to degrade implants before use. The result: early wear and potential device failure inside patients.

3. How many lawsuits are in MDL 3044?

As of early 2024, over 1,090 lawsuits had consolidated into MDL 3044 in E.D.N.Y. By late 2024, total lawsuits—federal and state—grew to roughly 2,600.

4. Why did Exactech file for bankruptcy?

Exactech filed Chapter 11 in October 2024. It cited mounting recall-related litigation and about $352 million in debt. A stay on litigation followed.

5. Will the Exactech lawsuit go to trial?

Bellwether trials were scheduled for 2025, but the bankruptcy stay likely halted them. Future litigation depends on bankruptcy outcomes and trust formation.

6. Who is TPG and are they responsible?

TPG is a private equity firm that acquired Exactech in 2018. Courts initially dismissed claims against them due to limited evidence. That decision faces renewed scrutiny.

7. What compensation can claimants expect?

Estimates range from $100,000 to $300,000 per claimant. The final amount will depend on injuries, revision surgeries, and available funds.

8. What should I do if I have an Exactech implant?

Check your device via Exactech’s recall lookup or ask your surgeon.

Consult your doctor if you feel pain, swelling, instability, or have had revision surgery.

Document records: surgeries, imaging, bills.

Talk to a lawyer experienced in MDL and bankruptcy.

Monitor updates through MDL and bankruptcy sites.

9. How will the bankruptcy affect claims?

Exactech’s restructuring plan may create a trust for claim payments. Litigation remains paused during reorganization. If the trust lacks funds, payout per claimant could reduce significantly.

Conclusion

The Exactech lawsuit spotlights real pain, legal complexity, and corporate responsibility. Patients endured device failure, medical costs, and life disruption. The recall triggered MDL consolidation, bellwether trials, and a major bankruptcy. That bankruptcy now dominates outcome timelines. Many fears and hopes ride on proposed trust. Claimants must act fast once deadlines appear. Lenders may gain control. The trust process replaces traditional trials. Still, justice remains possible. You now understand the causes, legal path, and what steps to take. You now know how the Exactech lawsuit will impact many lives and the medical industry moving ahead.