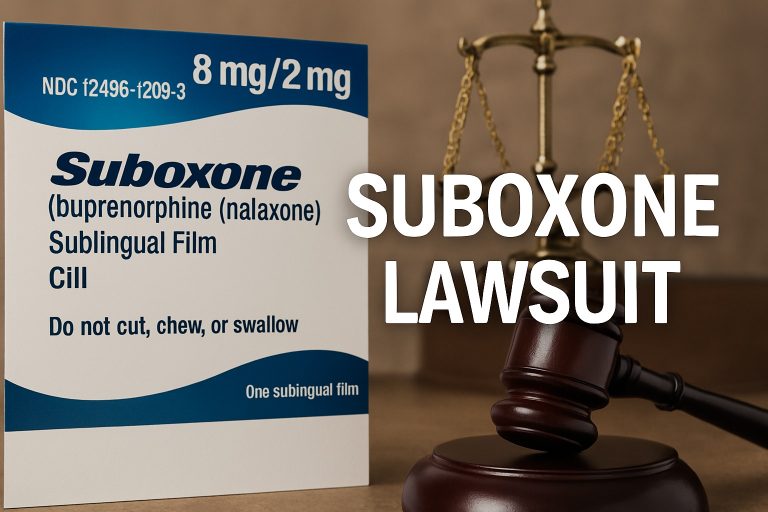

The talcum powder lawsuit hits deeper than simple civil claims. Plaintiffs argue talc caused ovarian cancer or mesothelioma. They accuse Johnson & Johnson of ignoring asbestos risks. Courts now hear thousands of claims. A major bankruptcy attempt failed this spring. That denial returns cases to active litigation. Judge Shipp now controls an enormous MDL docket. Trials and appeals loom ahead. Future verdicts will define liability limits. This article unpacks every key element. It guides readers step by step.

Snapshot of the Litigation

Johnson & Johnson sells no talc-based baby powder in the U.S. It stopped talc sales years ago. Plaintiffs continue filing cases in state and federal courts. Courts placed most suits in MDL 2738 in New Jersey. That MDL now holds over sixty thousand cases during summer 2025. Case variety spans ovarian cancer, mesothelioma, and medical monitoring requests. Lawyers track trends across more than a dozen jurisdictions. Defendants still face individual trials in many states. That breadth keeps pressure on both sides. Firms set reserves for potential losses. Public trust remains a fragile asset.

Where the MDL Stands Today

Judge Shipp oversees MDL case flow and expert disputes. He recently ordered repeated Daubert challenges. Parties expect a new pool of vetted expert opinions. That process will weigh scientific reliability. A special master helps assess evidence credibility. New orders could shift trial schedules significantly. Plaintiffs and defense counsel strategize accordingly. Some hope streamlined evidence will spur settlement talks. Risk models now rest heavily on upcoming rulings. The judge’s rulings may influence future verdict choices. Those rulings could reshape expert boundaries across trials.

The Third Bankruptcy Attempt Failed

Johnson & Johnson tried again to shield itself via bankruptcy. It used a Texas Two-Step structure with Red River Talc LLC. The plan proposed billions in settlements linked to bankruptcy. A Texas court rejected that plan on March 31, 2025. Judges cited improper solicitation methods. They also focused on release overreach for non-creditors. Bankruptcy protection lapses on denial. Defendants now must defend claims in regular tort venues. That result surprised many observers. It forces the company to revisit trial posture and budgets. Legal teams revisit trial readiness plans across jurisdictions.

What That Rejection Means

Bankruptcy could have paused nearly all litigation. Dismissal means no pause now. Plaintiffs can resume seeking jury verdicts. Defendants face high-stakes exposures. Settlement strategies may now shift. They may favor deals outside bankruptcy law. State and federal judges regain control. The tort system regains momentum. J&J now must defend each case on merit. Risk remains high for large-scale verdicts. The company reassesses its public messaging strategy.

Government Cost Recovery Pressure

Federal agencies intervened over public cost concerns. HHS and VA flagged potential reimbursement claims. Officials estimate over one billion dollars in compensation. That figure covers cancer treatments tied to talc exposure. Courts will need to balance consumer settlements and taxpayer exposure. Agency involvement adds complexity to negotiations. Plaintiffs now include potential public cost offsets. That dynamic reshapes offers and demands. Liability insurers watch closely. Government payers expect transparency and fair settlement terms.

Recent Verdict Signals

Some juries still side with plaintiffs. A judge in Massachusetts awarded $42.6 million for mesothelioma in July 2025. That verdict comes amid heated pressure over asbestos exposure. Johnson & Johnson plans to appeal. Other verdicts remain contested. Appeal outcomes could change liability exposure drastically. Defendants argue tainted science in some cases. Plaintiffs counter that exposure harm remains real. Losses like that verdict pressure both settlement planners and risk modelers. Future bellwether trials may hinge on such verdicts.

Company Position in Plain Terms

Johnson & Johnson insists its talc products were safe. The company emphasizes decades of quality assurance. It denies asbestos presence. It labels expert testimony as speculative and repeats confidence in product safety records. Press releases stress commitment to defense strategies. Leaders also focus on recent appellate victories. They plan further litigation. Investors await clarity on reserve levels. That transparency matters to ratings agencies. Legal strategy now focuses on trial-by-trial defense.

Plaintiff Position in Plain Terms

Plaintiffs claim that asbestos-tainted talc caused disease. They cite decades of internal research and testing. Also, they allege the company ignored material risks. They say warnings came too late or not at all. Family plaintiffs assert personal losses. Lawyers argue breaches of duty and misrepresentation. Their filings detail usage history and diagnosis. Many seek medical monitoring even without diagnosis. They include expert testimony on epidemiology and toxicology. Their narrative emphasizes consumer trust broken over decades.

Science at the Center

Talc and asbestos minerals often appear in same deposits. Cross-contamination risk remains high. Plaintiffs cite a body of epidemiological studies. Defense experts dispute exposure levels and causation. Courts now demand strong, reproducible science. The new Daubert phase tests reliability. Experts must meet stringent evidentiary standards. Fluorescent microscopy and air sampling methods face scrutiny. Analytical methods must meet peer-reviewed protocols. That scrutiny raises the bar for both sides equally.

Why Daubert Battles Matter

Expert admission decides what juries can hear. Judges act as gatekeepers. Admissible opinions shape case narratives. Exclusions weaken evidence power. Inclusion can boost settlement chances. Parties now file extended reports and response briefs. Courts may hold evidentiary hearings. That effort may last months. Outcomes will define trial readiness. Both sides expect dramatic shifts in negotiation power based on rulings.

State Court Momentum

Some state courts already set trial dates. J&J watches hotspots like Missouri, New Jersey, and Mississippi. Plaintiffs often choose jurisdictions with plaintiff-friendly law. Outcomes in those courts influence federal negotiations. State verdicts defy settlement trends quickly. They will affect overall case value. They often trigger parallel appellate battles. State courts also shape national media narratives. Defense allocates resources across state divisions accordingly.

Settlement Talk Temperature

Media speculation varies. Proposed deals have ranged from $6.5B to $10B. Bankruptcy-linked plans failed. Parties now revisit settlement negotiations outside court supervision. Plaintiff coalitions push for multi-billion dollar offers. Defense counsels gauge risk thresholds. Low-but-certain offers may appear soon. Pressure from government reimbursement claims may push terms higher. Negotiators evaluate cost savings from global agreements. Public sentiment, defense budgets, and verdict trends all influence timing.

How Many Cases Exist Now

Lawsuits grow monthly. Public estimates exceed sixty thousand cases this year. MDL remains the central hub. State courts host additional filings. Plaintiff attorneys track additions closely. Submissions and case inventories update frequently. That size overwhelms trial capacity. Itdrives future settlement urgency. Defense must allocate teams to manage mass discovery. Courts struggle with scheduling. That backlog builds systemic pressure toward resolution.

What Consumers Ask Most

Many ask: “Should I file?” Eligibility depends on diagnosis and location. Many firms offer free case reviews. Documenting product use remains key. Purchase records and photos help support claims. Diagnosis timelines also matter. Statutes of limitations vary by state. Medical monitoring claims may proceed even without cancer. People also ask about settlement timing. Experts say resolution may still take years. Outcomes hinge on trial results and negotiations. Patience remains critical in decision-making.

Timeline Highlights

2016–2019: Major verdicts bring national headlines.

2020: J&J ends U.S. talc Baby Powder sales.

2021–2023: Two LTL Management bankruptcy attempts fail.

2024: Judge Shipp orders new Daubert process in MDL.

March 31, 2025: Bankruptcy plan rejected in Houston.

July 29, 2025: Jury awards $42.6M in Massachusetts mesothelioma case.Summer 2025: MDL exceeds 60,000 cases. Trials and expert challenges mount.

What to Watch Next

Judges will rule on Daubert motions soon. Trial dates will emerge for key bellwether cases. Settlement rumors may rise. State hearings will continue across jurisdictions. Government reimbursement actions may appear. Appeals may begin on new verdicts. Defense will reassess liabilities post-appeals. Plaintiffs may file new claims or coordinate. Media coverage may intensify after verdicts. Legislative interest may grow. Outcomes will affect law and regulation dynamics.

Practical Notes for Potential Claimants

Documenting product use matters. Save packaging images if possible. Gather medical records supporting diagnosis. Note exposure timelines accurately. Consult attorneys early. Confirm statute deadlines. Ask about trial strategy and venue. Review attorney fee structures. Prepare expectations for timeline. Realize complex trials and appeals take years.

Balanced Health Context

Talc exposure risk depends on usage patterns and biology. Health agencies review studies continually. The public should consult trusted health professionals. Legal rulings test liability, not medical care. Patients deserve medical advice, not speculation. Doctors still guide treatment, prevention, and screening. Court outcomes do not change medical protocols.

Reading List: Recent, Reputable, and Useful

- Reuters, March 31, 2025 – Judge rejects J&J’s $10B Texas-style plan.

- AP News, Spring 2025 – Overview of bankruptcy denial and implications.

- Financial Times, Spring 2025 – J&J’s strategic response and business impact.

- U.S. District Court (D.N.J.) – Official MDL docket and scheduling orders.

- Reuters, July 29, 2025 – $42.6M verdict details and appeal plans.

- Verus litigation update, early 2024 – New Daubert briefing explanation.

- J&J press release, March 31, 2025 – Official company statement.

- Consumer Notice case tally, mid-2025 – Case counts and MDL summary.

Conclusion

The talcum powder lawsuit now enters a critical new stretch. Courts reject bankruptcy protection once again. MDL returns to expert battles and trial scheduling. Government cost claims add new pressures. Verdicts like the recent $42.6 million stay central. Settlement paths remain uncertain. Both sides prepare for prolonged litigation. Trials and appeals will define outcomes. This lawsuit tests medical, legal, and corporate boundaries. It will likely reshape mass tort strategy for years. The talcum powder lawsuit now begins its next chapter one courtroom at a time.

Ayesha Awais is a content writer for JudicialNexus.com, covering accident reports, injury-related news, lawsuits, and public safety updates. All content is informational in nature and based on publicly available sources.